Mortgage Matchmaking: Navigating Airbnb-Friendly Lenders

Airbnb mortgage lenders offer unique financing options tailored to investors interested in short-term rental properties. These loans differ significantly from traditional home mortgages due to the nature of investment properties.

Airbnb mortgage lenders offer unique financing options tailored to investors interested in short-term rental properties. These loans differ significantly from traditional home mortgages due to the nature of investment properties.

- Higher down payments: Typically at least 15%.

- Increased interest rates: Riskier investment translates to higher costs.

- Eligibility requirements: Stricter credit and income criteria.

- Versatile loan types: Options such as conventional loans, cash-out refinance, and HELOCs.

Navigating the sea of choices between different Airbnb mortgage lenders can be daunting. However, understanding your options and the risks involved is crucial for maximizing your investment returns. With the right lender, your short-term rental investment can become a lucrative income stream, bolstering your portfolio and generating passive income.

Top 5 Airbnb Loan Types

When diving into short-term rental investments, selecting the right loan can make all the difference. Let's explore the top 5 Airbnb loan types that can help you secure and maximize your investment property.

1. Conventional Home Loan

This is the go-to option for Airbnb hosts with a solid credit history. Conventional loans are typically used for purchasing primary residences but can also be leveraged for investment properties.

- Credit Score: Generally requires a minimum score of 620.

- Down Payment: Usually 20% of the property's value.

- Interest Rate: Competitive rates, although slightly higher than primary home mortgages.

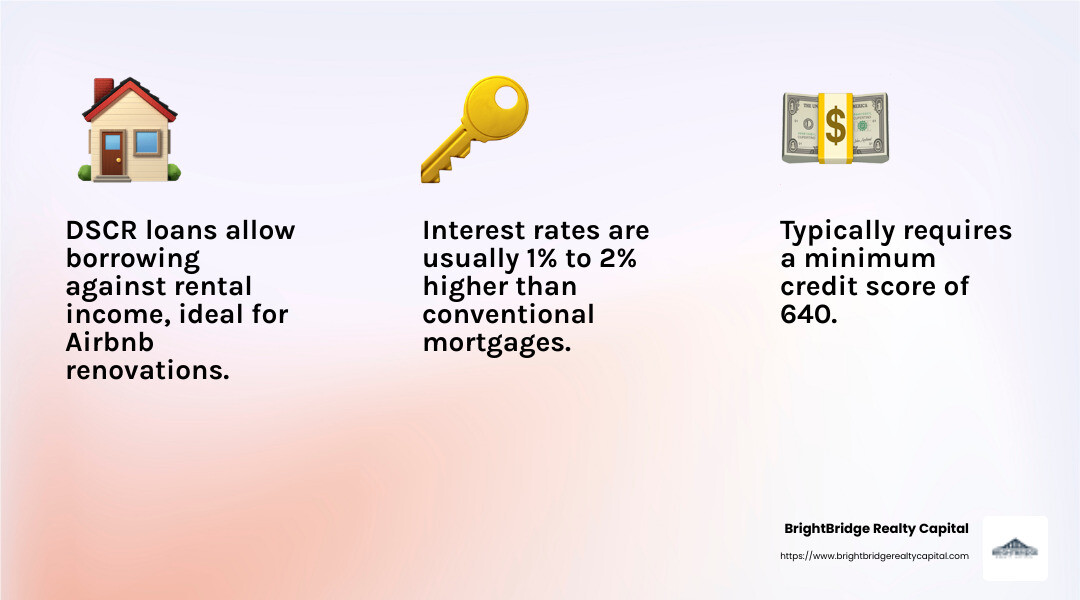

2. DSCR Loan

The Debt-Service Coverage Ratio (DSCR) loan is perfect for those looking to renovate or furnish their Airbnb property. It's a favorite among investors who want to borrow against rental income.

- Credit Score: A minimum of 640 is often needed.

- Down Payment: 20%-25% of the property price.

- Loan Terms: Typically 15 to 20 years, with interest rates 1%-2% higher than conventional mortgages.

3. Cash-Out Refinance

Homeowners with significant equity can tap into it using a cash-out refinance. This option replaces your existing mortgage with a larger one, allowing you to use the difference in cash.

- Best For: Buying a second home to rent out on Airbnb.

- Credit Score: Minimum of 620.

- Cost: Interest rates are 0.125%-0.25% higher than conventional mortgages.

4. Home Equity Loan

Known as a second mortgage, a home equity loan provides a lump sum of cash, ideal for covering down payments. It's secured by your primary home, so there's some risk involved.

- Interest Rates: Higher than conventional loans, around 8.63%.

- Loan Limit: Up to 85% of your home’s value.

- Use Cases: Down payments, renovations, or furnishings.

5. HELOC

The Home Equity Line of Credit (HELOC) offers flexibility with a credit line you can draw from as needed. It’s secured by your home and is ideal for ongoing expenses.

- Draw Period: Typically 10 years, with interest-only payments.

- Repayment Period: 10 to 20 years.

- Fees: May include annual maintenance and membership fees.

Choosing the right loan type depends on your financial situation and investment goals. Understanding these options will help you steer the complex landscape of Airbnb mortgage lenders and make informed decisions for your short-term rental business.

Airbnb Mortgage Lenders: Key Considerations

When it comes to securing a loan for your Airbnb investment, understanding the key considerations is crucial. Let's break down the essentials: credit score, down payment, loan terms, and property appraisal.

Credit Score

Your credit score is a critical factor for Airbnb mortgage lenders. It affects not only your loan approval but also the interest rate you'll receive.

- Minimum Requirement: Most lenders require a credit score of at least 620 for investment properties. However, a score of 740 or higher can secure better rates and terms.

- Impact: A higher credit score can lower your interest rate, saving you money over the life of the loan.

Down Payment

Investing in an Airbnb property typically requires a larger down payment compared to a primary residence.

- Percentage: Expect to put down between 15% and 25% of the property's value.

- Why It Matters: A larger down payment reduces the lender's risk, potentially leading to better loan terms and lower monthly payments.

Loan Terms

Understanding the terms of your loan is vital for planning and budgeting.

- Length: Loan terms can vary, with common options being 15, 20, or 30 years.

- Type: Loans can be fixed-rate or adjustable-rate. Fixed-rate loans offer stability, while adjustable-rate loans might start lower but fluctuate over time.

- Interest Rates: These are influenced by your credit score, down payment size, and current market conditions.

Property Appraisal

A property appraisal is a mandatory step in the mortgage process. It determines the property's market value and potential rental income.

- Purpose: Lenders use appraisals to ensure the property is worth the loan amount. For Airbnb properties, the appraisal might also consider potential rental income.

- Impact on Loan: The appraisal affects how much you can borrow and might influence your interest rate.

By focusing on these factors, you can better prepare yourself for the mortgage application process and improve your chances of securing favorable terms from Airbnb mortgage lenders. Up next, we'll address some frequently asked questions about Airbnb mortgages to further guide your investment journey.

Frequently Asked Questions about Airbnb Mortgage Lenders

What are the requirements for an Airbnb mortgage?

When you're looking to secure a mortgage for an Airbnb property, there are several key requirements to keep in mind. Let's break them down:

Credit Score

Your credit score is a major player in determining your eligibility for an Airbnb mortgage.

- Minimum Score: Most lenders look for a credit score of at least 620. However, a score of 740 or higher can lead to more favorable loan terms.

- Why It Matters: A higher credit score can reduce your interest rate, which means lower monthly payments and savings over the life of the loan.

Down Payment

The down payment for an Airbnb mortgage is typically higher than for a primary residence.

- Typical Range: Expect to put down between 15% and 25% of the property's purchase price.

- Importance: A larger down payment reduces the lender's risk and can lead to better loan terms. It also means you'll have more equity in the property from the start.

Property Appraisal

An appraisal is a necessary step in securing a mortgage for your Airbnb.

- Purpose: This assessment determines the property's market value and, for Airbnb properties, may also consider potential rental income.

- Impact: The appraisal helps the lender ensure the property is worth the loan amount. A favorable appraisal can affect how much you're able to borrow and the terms of your mortgage.

By understanding these requirements, you can better prepare for the mortgage application process and improve your chances of securing a loan with favorable terms. If you're ready to explore your financing options, BrightBridge Realty Capital offers custom solutions to help you fund your Airbnb investment journey.